Home |

Up |

Next |

Prev |

Karl Marx, Standard Oil & Bill Gates; influential players in the history of capitalism.

Introduction

Wikipedia defines capitalism as "an economic system based on the private ownership of the means of production and their operation for profit." When you look at it more closely however you find that it has been used to mean different things by different people at different times, so for the purposes of this article I will define it as: "An economic system whereby goods and services are traded for money by companies owned by shareholders. In this system a company is run by a board of directors appointed by the shareholders, shares are traded on a stock exchange, workers are paid money for their efforts and shareholders are given some or all of the profits. The system is built on the natural self-interest of mankind and the benefits of competition. Ideally all these trades take place in a free market where better and cheaper products out-compete their inferior and less efficient rivals. It is accepted that the system is neither democratic nor equitable and that shareholders in successful companies will become richer while there is no guarantee that workers will share in any of that extra wealth. However, in theory at least, a valued worker can trade himself on the employment market and find a better deal elsewhere if he is unhappy. Furthermore workers have the right to unionise to avoid being overly exploited." Essentially: Capitalism is a system whereby everything can be traded for money and everyone can attempt to participate in any way they wish.

In the early part of the 20th century the question of which economic system is best was still up in the air. Thanks to influential thinkers like Karl Marx communism was seen by many as a legitimate alternative to the incumbent capitalism. However, since then, communism has been thoroughly tested over many decades by the USSR, China, Cuba, North Korea etc and in every case it led to the impoverishment of its citizens and removal of their civil rights, thereby proving beyond a shadow of doubt that Marx was WRONG! The "West" with its free market capitalism roared to the forefront of civilisation with the common worker in the USA after the war accumulating wealth many times that of the workers in communist regimes. Nor were their civil rights removed, quite the contrary, as US citizens enjoyed free speech and the right to chose a new leader as a constitutional right.

The 1960s in the "West" can be seen as a high watermark of the capitalist system from the point of view of the workers. Common workers could expect to own their own spacious, modern home and garden as well as their own motorcar in which they could drive to work. For the devotion of 40 hours per week to the company by 1 person, they could raise a family, watch TV, school their children, take annual holidays, smoke, drink, go out every week and retire at 65. This had never even been seriously thought possible before. Wow! Life was good and the music was even better!

In this near utopia there were many companies competing for each market segment and they were correspondingly innovative, caring and efficient. By and large, companies valued their customers and employees, directors and managers worked for the long-term viability of their company and usually stayed there for life, dividends were paid but the obsession with maximising them in the short term at the expense of the long term was frowned upon and unionism was tolerated so long as the company got an effective, reliable, affordable work force. Investors bought stocks as a long-term investment, share prices generally moved slowly and short-term trading was rare.

What's not to love? Sadly this halcyon period was not to last as we shall see...

What's Wrong With Capitalism?

"Chainsaw" Al Dunlap (slash & burn CEO of Sunbeam), Asahi Group HQ (beverage takeover kings), The drive for dividends (at the cost of the company).

From the 1980s onward we began to see a new greed and irresponsibility from the CEOs and directors of major companies. The focus switched to short term gain, dividends went through the roof, assets were sold off and leased back, employees were sacked even though the company could afford them, short-term share trading took off, companies were taken over and merged at an unheard of rate, CEO's salaries became utterly obscene, "care for your customers" became "screw your customers as hard as you can", management jumped from one company to another in an insane race to earn ever more, the quality of products dropped away markedly as did their life expectancy, poorer people's real wealth dropped away as the real estate market was manipulated by the wealthy, viable businesses were closed down, both parents had to go to work and the great music died.

Today we have a world where new products barely work, no one takes responsibility for anything, the cost of services has gone through the roof, you can't ring a real person at a company to get help with their product/service, real estate is unaffordable, workers are incompetent, there is little choice of products as most market segments are dominated by just 2 or 3 companies, there is little really useful innovation, perfectly good viable products are discontinued, workers are often expected to contribute extensive unpaid overtime, commuting time is often 2 hours per day, shopping malls are full of chain stores offering the same bland, unappealing products and services, take-away food is revolting and music is nonexistent. How did we get from the 1960s utopia to this mess? Well, the answer is that various unscrupulous greedy people saw loopholes in the system and exploited those loopholes for their own short-term gain, ruining paradise in the process. This doesn't mean that capitalism has failed, merely that it needs some tweaking to close those loopholes. So with that in mind, let's look at what the issues are that need fixing.

- There is no inherent morality in the system: Current day capitalism revolves around short-term money and ONLY short-term money! It is quite easy to see that such a basis is asking for trouble when the people that it is supposed to serve only need money to supply their essentials. What they really want is HAPPINESS, which as everyone knows can't bought with money!

- The takeover option encourages monopolies which defeats competition: One of the great planks of the capitalist system is that it encourages COMPETITION, which works to the benefit of the consumer and the innovator. Unfortunately some shady people from boring rich companies realised that instead of COMPETING with smaller, more innovative rivals they could simply BUY THEM OUT! This quickly became part of the directors' playbook and the number of truly independent companies quickly shrank to just a few. A classic example is the music recording industry where a hundred significant labels in the 60s were reduced to just 3 at the time of writing. Other examples include the car industry, the mobile phone industry, the software industry, the home appliance industry, the beverage industry etc.

- It is difficult to strike the optimal balance between workers interests and company interests: Businesses like to keep their costs to a minimum, this is natural and their biggest cost is often labour. Workers like to get as much money as they can in exchange for their sacrifice of time, effort and expertise, this is also natural. These two drivers are ALWAYS going to be at odds with each other so a balance must be struck!

In a world where jobs are sought after and a company need only pay the minimum required to land a worker, salaries will always be low. Conversely, in a world where workers are sought after, salaries will be high. This is the case in a free employment market but to protect workers from slavery we have trade unions. Ideally these should operate to maintain a happy balance, but, of course, greed and self-interest soon take over and we find that certain powerful unions such as the maritime workers and the construction workers are able to force pay and conditions that are absurdly high. These unnecessary expenses act as a brake on new developments in those areas that might otherwise employ more people, alternatively such high costs are passed down the chain to the consumer, resulting in higher costs of products. Meanwhile workers who are unrepresented or whose union is ineffectual are driven to the wall. Neither extreme is desirable. - The dividend mentality encourages the pursuit of short term profit at the expense of long term viability: Once upon a time the dividend was a small reward for stock holders who stuck with the company, now it is in many cases the ENTIRE REASON for the company! Selling off your equipment and then immediately leasing it back is insane from a long-term perspective. You can only lose on the deal! No private individual would do that with his own things but, of course, the company's things are usually NOT the things of the CEO. He doesn't care if the company fails in the long-term, he has put some money on the balance sheet in the short-term. That short-term money can then be parcelled out to the big shareholders, the company's share price will increase and they will then instruct the board to raise his salary to some even more obscene level, even though he has just hurt the company in the long term.

- There is no long-term commitment for directors or senior management to the company: Once upon a time senior management and directors were prudent, honest men with a long-time association with the company, who were dyed-in-the-wool believers who saw it as their sovereign duty to safeguard and foster the long-term future of the company through good times and bad until they retired. So it was in the golden era of capitalism but NO MORE!

Today's senior managers are in general a mercenary bunch of self-interested greed merchants who jump from company to company as it suits them, always looking out for a better deal for themselves. They have no allegiance to anyone except themselves. Today's board members are the mates of other board members and the puppets of the big investment houses. They all piss in each other's pockets and they likewise have no allegiance to the company, only to their directors club where they all conspire to avoid rocking the boat and award themselves a very cosy existence.

These people don't want the company to fail in the short term as that would reflect badly on themselves, but they have no interest in its fortunes in the long-term. In fact, it is in their interests to get out early, before the shit that they have presided over hits the fan. - There is no enforced mechanism for promotion on merit: Incompetence begins at the top and soon infects the entire company but CEOs and senior managers are appointed by the board. Why would they appoint idiots? Because, of course, the board don't care about the long-term interests of the company. They want short term profit and shareholder value and they will appoint ANYONE whom they think will supply that. Modern share price is very sensitive to appearances so they appoint someone who LOOKS right, who SAYS the right things and who gets the share price moving upward. They don't care if he is a nong with little understanding or expertise in the company fundamentals so long as the market likes him.

So an amoral drongo becomes the CEO and he sets about removing any manager who knows more than he does. He replaces them with people like himself who only know how to find short term money. R&D is a significant expense that does nothing for the bottom line in the short term so he gets rid of it. Similarly the support staff, who are replaced with a call centre in India or the Philippines. In just a few years a genuine company becomes a shell that simply shuffles money around and avoids any responsibility. Once the market realises that the company isn't what it was it becomes ripe for a take-over offer which the CEO recommends as he leaves with his enormous golden parachute. - The major shareholders are not people: The reason boards appoint bad people and make bad decisions that are not in the interests of the company that they are supposed to be fostering is because they are not people that are genuinely interested in the company, instead they are representing large investment houses that are only interested in maximising their shareholder value. They are companies, NOT PEOPLE! You cannot expect such creatures to foster the long-term interest of a company.

- Superannuation investment houses create enormous bubbles: Quite a while before the baby-boomer generation approached retirement age governments realised that they wouldn't have the resources in the future to fund that huge population retirement bubble with government pensions. The solution was compulsory personal superannuation which would mean that most retirees would be self funded. A great idea! Kudos to those treasury departments that put it together but they forgot one thing: There aren't enough meaningful, useful, new investment vehicles to soak up all that money! The money has to go somewhere though, so it is pumped into overpriced, existing investments that don't need additional funds, creating immense financial bubbles that must one day burst, leaving the managers rich and the retirees poor.

So where does the money go? Well into anything that might offer a return:

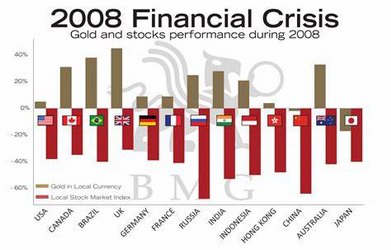

The share market primarily, where it inflates share prices far above their true value, creating a bubble that must one day burst and precipitate the greatest economic catastrophe the world has ever seen. Once a company's Price/Earnings ratio exceeds 20 it is an indication that a company is possibly over-valued. When the PE for the entire market is above 20 it is cause for concern and when it exceeds 30 the market is likely heading for a violent correction. In 2008 the S&P 500 hit 60 which was followed by the terrible GFC where an astonishing amount of apparent wealth was wiped out almost overnight. In 2001 it hit 46 which precipitated the 2001 contraction. History repeats folks but people forget or think that this time will be different.

The housing market is another favoured destination, where the inflated prices it creates make vendors rich but become a disaster for poor people who suddenly find housing unaffordable and have to take substandard accommodation or become homeless and live in their cars or out on the street. More importantly though; young couples are forced to take out huge loans that are only serviceable in a nearly zero inflation economy and will become a terrible nightmare when interest rates finally rise. When that happens many people will lose their homes and investors who are caught holding the baby when the music stops will see their book value drastically reduced in the inevitable correction.

The bond market is a little different as there is only a finite amount of money to be had there. With interest rates at record low levels the profit is already gone from the older issues.

Precious metals like gold are always a beacon for investors but the price of gold is always a fantasy. Its real world value is usually far less than people are prepared to pay for it. Gold is usually a bubble and it becomes far worse in a market flooded with cash. In 2000 it was $300 US per oz. Today it is $2,000 US. Is it actually worth that? Of course not! It is an enormous bubble filled with hot air!

Commodities like corn, oil, meat etc can be driven up by investors depending on the circumstances of the day but there is only so much demand for any given commodity and unless supply is short there is a limit to the amount people will pay for wheat, beef, corn etc. Nevertheless commodity prices have increased roughly 3 times since 2000 which is far more than inflation. However these markets are highly volatile, (especially oil), so they are not the preferred choice for most investors.

How To Fix It

It must be said that the governments and economists of the world must be either incredibly stupid or have their head up their arses not to see the mess that is here now and the disaster that is to come. Certainly I don't see any mention of these facts on any media source at the moment. Perhaps all these people are just so financially invested in the lie that they can't point the finger at the elephant in the room lest they lose their jobs or maybe they are worried but can't see any way out... Having said that, as usual it is up to Mr Mars to say the unsayable and to find the solutions to the problems that people don't even know exist.

The over-riding principle in fixing the problem is to remove the modern notion that a company is primarily a profitable investment vehicle and return to the original idea which was that a company is a thing that produces something useful for society and employs people in the process. Behold:

Fixing The Superannuation Crisis

Pension funds are creating a bubble that will cause another Global Financial Crisis

The greatest and most urgent of the problems listed above is the enormous bubble caused by superannuation funds. It WILL be the greatest financial disaster of the last 50 years and there will be much wailing and gnashing of teeth when the denouement finally arrives. On that day cash will be king, but few investors have their wealth in cash as it produces no return in the zero inflation regime we have been living in for the past 5 years.

The crux of the problem is that there simply aren't enough fairly-priced, profitable investment vehicles for the superannuation funds to sink their money into, so the money goes into pumping up the price of existing vehicles without generating any REAL new wealth. They have already inflated the share market and the housing market and various other markets but still the money keeps pouring in looking for a destination and it has to go somewhere. For the fund manager it is a no-brainer: "Existing vehicles have been generating enormous returns for the past 12 years without a hiccough so what's not to love? Sure, those vehicles are massively over-priced but don't worry about it, drink the kool-aid and don't rock the boat. In any event there is no alternative anyway."

Well that may be true but let's look at the alternatives anyway:

It can go into large privately-funded, public infrastructure projects but where is the return coming from if they are for public services such as roads, hospitals, schools, stadiums etc? People can only stomach so many toll roads and they only need so many hospitals, stadiums and schools. It can go into private infrastructure such as mines, factories etc, but there are only so many companies that want to embark on such ambitious projects and they will simply fund the process using their own debt. It can go into renewable energy projects but again, who is going to pay for them? There is only so much demand out there and the market is extremely competitive.

It can go into speculative commodities like gold, but deep down most fund managers realise that gold is a fantasy and there is a limit to how far they are prepared to ride that bubble. It can go into consumer commodities like oil, wheat and meat, but again, the market is highly competitive and consumers will not pay a premium for commodities unless they have no choice.

One possible solution is to invest heavily in unproven new industries such as space, AI, personal helicopters, undersea cities etc. Mining the asteroids or colonising the moon will soak up a LOT of money and will be in the long term interest of humanity BUT will it make a profit in the medium term? Probably not...

So it is that without a limitless new field of investment that will pay a reliable return in the medium term we must conclude that large scale superannuation is a BAD idea! I realise that this is heresy but in the end we must recognise the monster for what it is, no matter how unpalatable it may be for us to do so. The beast is inimical to our society and it must be dealt with!

Superannuation funds, (and in fact, any large funds management house), must be forbidden from inflating the price of existing vehicles! They have destroyed the good basis of capitalism thanks to their natural obsession with short term gain and their natural tendency to create bubbles. Without that endless flow of cash filling every nook and cranny the markets can go back to pricing things properly and people can go back to planning their lives in a realistic manner instead of the rich flying to the moon on huge bubbles and the poor being financially strangled.

But how do we prevent this inflation? Well, funds management houses may be restricted in what they can do as follows:

- They may invest in shares PROVIDED the PE ratio is less than 20. Once the ratio hits that mark they are NOT permitted to buy. This restriction is waived for startup companies for the first 2 years.

- They may invest in gold and other precious metals provided the price is less than twice the total cost of mining it and bringing it to the market.

- They may NOT purchase existing human housing unless they are planning to redevelop it. People should own houses, NOT companies! They may however develop housing for people to buy. They may not rent it out though nor hold on to it for the purpose of inflating its price.

- They may invest in NEW vehicles so that society gets some benefit from all that investment instead of the curse of bubble creation. Space exploitation and green energy could be appropriate examples. Naturally, new industries are high risk but that is the nature of the beast.

- They may store the cash invested in them by their members which they can allow the government, (or other special case borrowers), to use at some negotiated interest rate. This would be all the cash that they are forbidden to invest in existing, desirable vehicles. Essentially they would then be operating as a special kind of bank that doesn't compete with the existing banks. When their members are ready to retire they can withdraw that cash to use for their daily necessities and once the boomer bubble is passed the system will stabilise and there will be the same amount coming in as there is going out. Sure, this won't earn the returns they could get if they had free rein like they do now but TOO BAD! That is the price that must be paid to avoid bubbles and disasters.

It may be that when equilibrium is reached the markets will deflate somewhat and perhaps this will be what precipitates the next disaster. Nevertheless, even without the boomer bubble the sum total of the future compulsory superannuation funds will still be too much for the world's markets to handle. My above measures are designed to prevent disaster, albeit at a, (manageable), cost. It may seem unpalatable but it is a lot better than what is and what is to come!

He that hath ears, let him hear.

Fixing The Obsession With Short-Term Gain

Short term gain often takes you away from long term gain.

The damaging amorality in the system is due to the obsession of share-holders with short-term gain. This gain is usually achieved in two ways:

- By forcing the share price high, (by unhealthy means), and

- Through the payment of large dividends, (also by unhealthy means).

The two often go together and usually result in damage to the health of the company and its long term prospects.

Part 1 of the solution is simply to FORCE shareholders to hold their shares for the long-term. Banning the sale of shares until the holder has had then for at least 10 years will force shareholders to focus on the true health of the company rather than what they can make if they sell their holding now.

Part 2 of the solution is to limit the amount of money that may be paid in dividends. By limiting it to the same return as bank interest you remove the incentive for shareholders to buy shares simply for the dividends. You also force the company, assuming it made a decent profit, to invest in itself by purchasing new equipment, hiring new workers, spending on R&D, paying down debt or simply saving money for a rainy day. All of these things improve the true health of the company and set it and its workers up for a better future.

Fixing The Take-Over Problem

Sony, Universal & Warner: These three companies own ALL of the significant record labels in the world! No wonder music is dead.

As previously mentioned, the take-over mentality destroys real competition which harms the consumer's choice and damages society. The simplest way to solve this problem is to simply BAN take-overs by a market competitor. This prevents predatory actions by rich companies on successful rivals. A failing company however may still be thrown a lifeline by another agent who wishes to acquire them but they must be from another industry segment.

Companies that want to MERGE may still do so if it is a true merger and not a take-over but only if there are sufficient players in that market segment in that country.

A healthy industrial market segment requires a minimum number of large viable players to ensure true competition. This amount varies depending on money available for the segment, the population of the country in question, whether the segment is growing or declining etc. It is not possible to provide a single figure. It is however possible to provide a figure for a given industry in a given country at a given time. This figure should be established by the government of the country in question and should be updated each year.

In general however, world-wide there should be at least 10 large, viable players in any given large-scale industry, for example car manufacturing, telecommunications, livestock, clothing, household appliances etc. For each large prosperous country there should be at least 3 large, viable players competing in the that industry.

In the case of smaller countries in a given market segment there should be at least 1 viable player that can compete in the international market. While it remains profitable it must not be taken over.

In the case of medium scale industries such as: computer gaming, fast-food chains, supermarket chains, retail chains, furniture manufacturers, exercise products etc, each country, unless very small, should endeavour to have at least 3 players per segment whether they operate internationally or not.

3 is the magic number for country-wide competition, below this you don't have reliable competition. Mind you, you can still have 3 or more players who conspire with each other to stifle competition between them and a government watchdog is essential to prevent this.

In the case of a market segment where there are less than 10 players internationally or less than 3 players locally, the largest player or players must be broken up fairly to achieve the required minimum number of viable players. If a small country has a viable international player which has no local competitors a case may be made to prevent its breakup if that would ruin its international viability.

Establishing A Fair Rate Of Remuneration For Employees

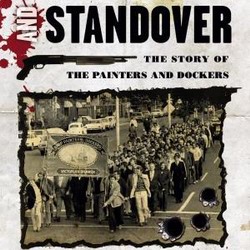

A low paid worker with no representation, Arbitration; a way to prevent either extreme, The story of the militant and corrupt Painters & Dockers Union.

Too much power to the workers' union and worker costs become excessive and the company suffers. Too little and the workers suffer. Balance is the magic requirement here but how to achieve it?

The best idea is an independent umpire who can consider both sides and make a legally enforceable decision. Such bodies can become overly political though, so some general principles should be enshrined to underpin any such decisions.

Capitalism is based on the natural self-interest of human beings. There must be a personal incentive for each person to go work and to do their best. The chance of promotion to a better paid job provides such an incentive. If you devote years of unpaid study to acquire a university education you deserve to be rewarded for that by expecting a higher salary. That is your incentive to study! A person with no drive, ambition or skill does not deserve to earn as much as someone who contributes more.

We should be rewarded in line with how we contribute to our society and there should be considerable difference between the top and the bottom to provide the necessary incentive. This is where capitalism differs from communism and we all know which system works! The gap between the top and bottom however should not be allowed to grow too large. We don't want too many really rich people. What we want is a content lower class, a large and dominant middle class, a significant wealthy class and just a sprinkling of high fliers.

- The full-time minimum wage must be enough to allow a person to maintain and own, (over time), a modest house and car and to supply the basic needs of a family of 4 people including any health and education necessities.

All workers must also be provided certain minimum conditions by the company such as a safe and comfortable workplace free from harassment by other employees, no unpaid overtime, 4 weeks paid holiday per year etc.

This sets up the minimum reward for participating in society. It means that EVERYONE who contributes has a reasonable expectation of a decent life. - No employee should be paid more than 6 times the minimum wage. This prevents CEOs being paid obscene sums and impoverishing the company in the process. If the minimum wage is $50,000 pa then the CEO can only make $300,000 pa. Note that this is still a very good wage! Non salary payment such as bonuses and share gifts etc are banned. If the CEO wants to own shares he can buy them like everybody else!

- Unskilled workers such as: shop assistants, drivers, fast-food workers, labourers, bouncers etc should never be paid more than 1.5x the minimum wage unless the work is extremely dangerous or extremely unpleasant. This prevents powerful unskilled unions from making certain industries uncompetitive.

- Semiskilled workers such as: plumbers, electricians, carpenters, teachers, nurses etc should never be paid more than 2x the minimum wage unless the work is extremely dangerous. This helps to provide an average standard for society.

- Highly skilled workers such as: doctors, scientists, engineers, lawyers, writers, dentists etc should never be paid more than 4x the minimum wage unless the work is extremely dangerous. This allows talented, highly educated people the chance to get a decent reward for their exceptional skills and long period of education.

- People who have very responsible jobs carrying a heavy stress load such as: politicians, senior managers, judges etc may be paid up to the maximum amount, (6x minimum). Such people are expected to devote their lives to their jobs and to do a first rate job under extreme pressure. Their decisions impact the lives of many other people and they must accept responsibility for what they do. Provided that they can live up to all this they deserve to be the best paid employees of society.

- If you want EXTREME wealth you must start your own company and create that wealth yourself. Under such conditions you can make far more than any employee. That is the basis of the capitalist system and that is your reward for adding to it.

There is a caveat here though: Workers that are in demand and who become a company simply to take contract work for themselves alone do not qualify for the entrepreneur exception as they are a company in name only. They must not charge more for their services than they could earn as an employee plus all their expenses. This puts a stop to plumbers, surveyors, consultants, programmers and the like charging absurd rates to perform tasks normally done by employees.

As a caveat to that caveat: People who operate on their own in segments where income is highly variable and unpredictable (such as: single person farming, acting or fishing), or who create unique products that no one else can, (such as: artists, poets, music composers and novelists), should be considered as legitimate businesses and are therefore exempt from the normal contractor provision.

Fixing Inhuman Shareholders

Fidelity Investments, BlackRock Inc & The Vanguard Group; when these behemoths control your board you have lost your company.

Investment houses are companies in their own right with a focus on short term returns and as such they are not human and not an appropriate choice for deciding company policy. Provided that they are not superannuation funds they MAY be appropriate shareholders but they should NOT be entitled to a vote in any shareholder meeting, their vast holdings notwithstanding.

In the absence of the large investment houses, the boards of company directors will then be filled with appointees chosen to foster the long-term health of the company. Such people might be long-term private shareholders, experts in the industry, retired proven effective and loyal employees etc. With the large investment houses banned from meetings the AGM of public companies will be an interesting event once more, where ordinary human, long-term shareholders ACTUALLY GET A SAY in who runs the company!

With the focus of the head of the company on a healthy company instead of the income of its share holders that is what you can expect to see and this will benefit not only that company but society as a whole. Naturally this begins with the appointment of sensible and expert CEO and senior management, who should soon have the place operating smoothly.

Fixing Incompetence

Carly Fiorina (HP), James & Kerry Packer (PBL), Dick Fuld (Lehman Bros); why you don't appoint CEOs based on looks, family connections or share price.

Incompetence begins at the top and propagates down as drongos promote their idiot mates to positions of influence, destroying the company in the process. Incompetent people can get to the top through various means but primarily these are:

- Through being appointed to achieve a goal that is at odds with the long-term health of the company, such as maximising share price and dividends.

- Through being appointed due to personal charm rather than expertise.

- Through being appointed due to personal connections rather than expertise.

Both of these means are the fault of the people that make the appointment. In the case of the appointment of a CEO or senior management these are the directors and it is they that must take the blame. But why do they do it?

In a world where the shareholders are investment companies the directors are merely the puppets of those companies, and as such are not really human beings. This can be fixed as detailed above. This takes care of the first category.

In the case of the second and third categories, we are all merely human and we are all susceptible to personal charm and obligation. Whether it is a beautiful woman, a handsome, suave man, a flatterer or simply a personal friend or relation, we may choose the wrong person through emotion rather than rationale.

So how do we enforce rationale and take the emotion out of it? One way is appointment by computer. You plug in your criteria and the attributes, expertise and experience of the applicants and the computer tells you the best fit. You then appoint that person, regardless of the board's preference. That person may not be particularly popular but the company will benefit in the long term.

Conclusion

These problems can be solved. Essentially you just need to stop people doing the wrong thing.

After conclusively demonstrating its superiority over communism the capitalist system is in crisis. There are many problems and iniquities in the world today that are of its making and a disaster is probably not too far away which will shake the system to its foundations.

The basis of the system remains sound however, based as it is on human self-interest, drive and inventiveness but the rules need some tweaking to restore its functionality to the halcyon days of the 1960s.

To fix the system requires some strong measures:

- The restriction on what investment houses are able to invest in.

- The prevention of short-term share ownership.

- The restriction of dividends to no more than bank interest.

- The prevention of takeovers by competitors and the breaking up of businesses without enough competitors.

- The restriction on how much employees and contractors can earn.

- The removal of company voting rights from investment houses.

- The implementation of computerised senior management appointment selection based on board-specified criteria.

You can bet that these measures will not be popular with the wealthy powerful people of this world and so it will be a battle to implement them. Nevertheless, implement them we must or the system will crash and crash again and many people will suffer and there may, eventually, be revolution in the streets which will not be pretty...

Perhaps after such a revolution though, these capitalist principles may be enshrined in law and we can look forward to a new golden age of a content working class, a dominant middle class and a thriving, innovative and competitive business sector. Let's hope so!

Warren Mars - March 21, 2022